Private Markets Move Along in More Challenging Market Environment

By Crescent Team

ASSET CLASS PERFORMANCE

FIXED INCOME MARKET UPDATE

Past performance does not indicate future performance and there is a possibility of a loss.

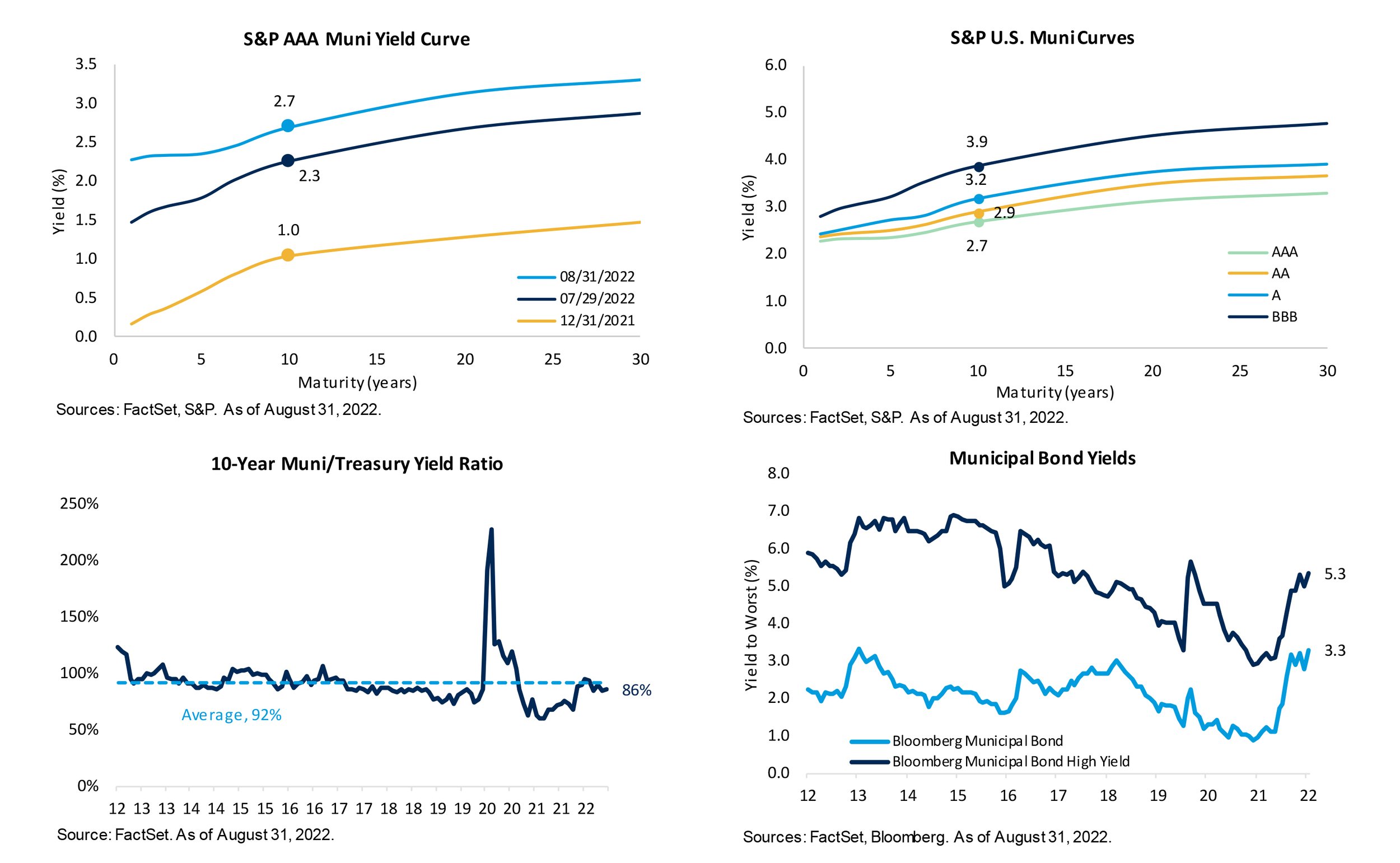

MUNICIPAL MARKET UPDATE

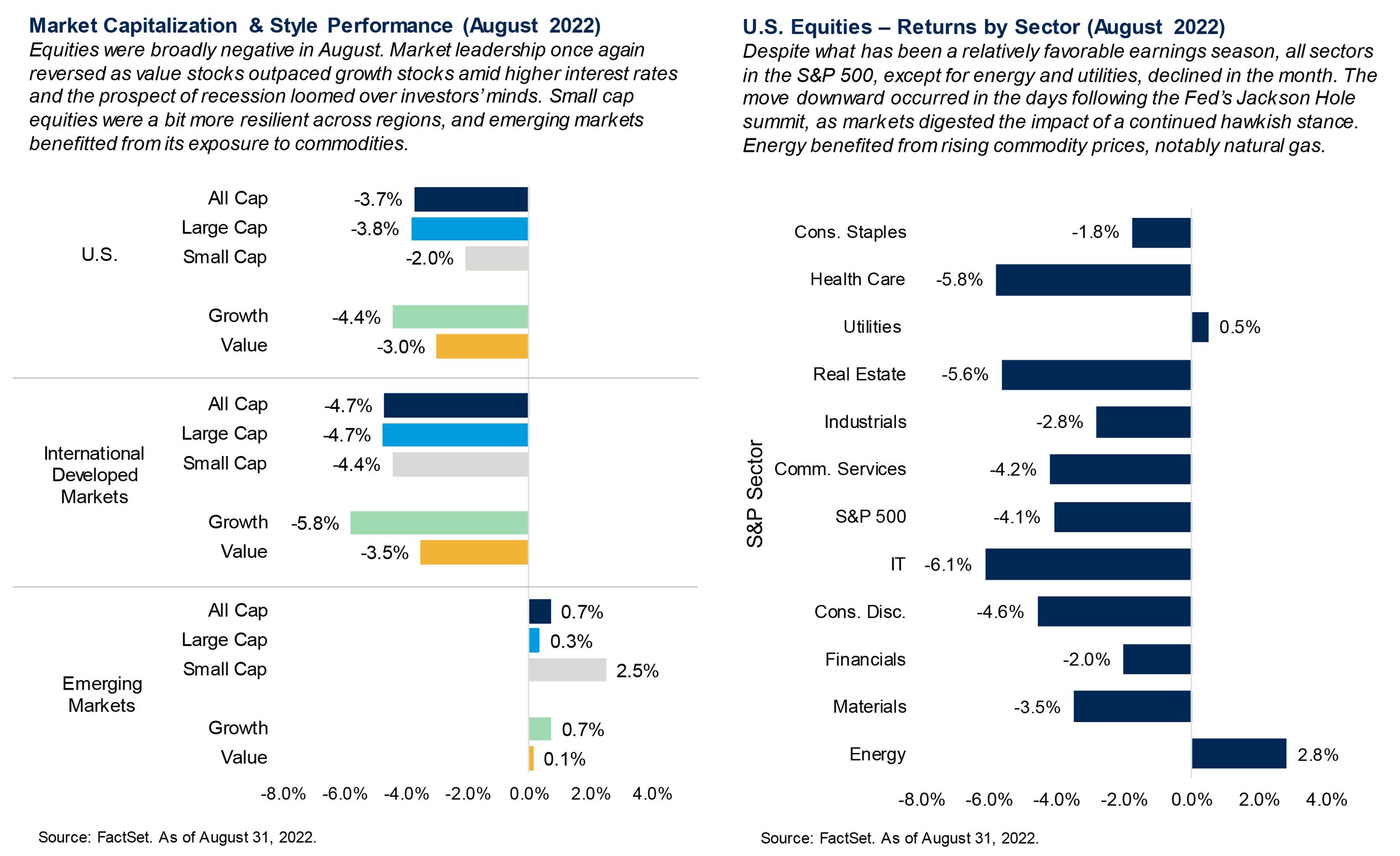

EQUITY MARKET UPDATE

Past performance does not indicate future performance and there is a possibility of a loss.

REAL ASSETS MARKET UPDATE

Past performance does not indicate future performance and there is a possibility of a loss.

FINANCIALS MARKETS PERFORMANCE

Download a PDF of this blog.

DISCLOSURES AND DEFINITIONS

All material and information is intended for Crescent Wealth Advisory business only. Any use or public dissemination outside firm business is prohibited. Information is obtained from a variety of sources which are believed though not guaranteed to be accurate. Any forecast represents future expectations and actual returns, volatilities and correlations will differ from forecasts. Past performance does not indicate future performance. This presentation does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice.

When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise notes. Each index is unmanaged, and investors can not actually invest directly into an index:

TIPS: Bloomberg Barclays Global Inflation-Linked: U.S. TIPS Total Return Index Unhedged

Municipals 5-Year: Bloomberg Barclays Municipal Bond 5 Year (4-6) Total Return Index Unhedged USD

Core Bond: Bloomberg Barclays US Agg Total Return Value Unhedged USD

High Yield Municipals: Bloomberg Barclays Muni High Yield Total Return Index Value Unhedged USD

High Yield: Bloomberg Barclays US Corporate High Yield Total Return Index Value Unhedged USD

U.S. Long Duration: Bloomberg US Aggregate Government & Credit - Long

Foreign Bond: Bloomberg Barclays Global Aggregate ex-USD Total Return Index Value USD (50/50 blend of hedged and unhedged)

EM Debt (unhedged): J.P. Morgan GBI-EM Global Diversified Composite Unhedged USD

Real Assets: S&P Real Assets

U.S. Large Cap: S&P 500 Total Return Index

U.S. Small Cap : Russell 2000 Total Return Index

International Developed: MSCI EAFE Net Total Return USD Index

Emerging Markets: MSCI Emerging Markets Net Total Return USD Index

World: MSCI ACWI Net Total Return USD Index

U.S. Equity REITs: FTSE Nareit Equity REITs Total Return Index USD

Commodities: Bloomberg Commodity Total Return Index

Midstream Energy: Alerian MLP Total Return Index

Hedge Funds: Hedge Fund Research HFRI Fund of Funds Composite Index

Event Driven: Hedge Fund Research HFRI Event-Driven Total Index

Relative Value: Hedge Fund Research HFRI Relative Value Fixed Income-Convertible Arbitrage Index

Equity Hedge: Hedge Fund Research HFRI Equity Hedge Total Index

Direct Fund Composite: Hedge Fund Research HFRI Fund Weighted Composite Index

Fund of Funds Composite: Hedge Fund Research HFRI Fund of Funds Composite Index

Macro: Hedge Fund Research HFRI Macro Total Index

International, 7% Emerging Markets, 5% U.S. Equity REITS, 6% MLPs

U.S.: MSCI USA Net Total Return USD Index

China: MSCI CHINA Net Total Return USD Index

Japan: MSCI Japan Net Total Return USD Index

Germany: MSCI Germany Net Total Return USD Index

India: MSCI India Net Total Return USD Index

United Kingdom: MSCI UK Net Total Return USD Index

France: MSCI France Net Total Return USD Index

Italy: MSCI Italy Net Total Return USD Index

Brazil: MSCI Brazil Net Total Return USD Index

Canada: MSCI Canada Net Total Return USD Index