Greenwashing in ESG: Don’t Judge a Book by its Cover

Greenwashing: expressions of environmentalist concerns especially as a cover for products, policies, or activities

By Crescent Team

With rising interest in Environmental, Social, Governance (ESG) investing the asset management community has been quick to respond. New strategies have been launched, existing strategies have been updated and marketing materials have been created. However, some investors are rightly asking what is marketing and what is reality? Recent headlines surrounding the departure of some high profile ESG professionals at large asset managers and the SEC’s renewed interest in helping investors look beyond the fluff has added to these concerns. To help wade through this debate we took an independent look at ESG integration across asset managers. To help set the stage, lets first define Integration

ESG INTEGRATION

We believe ESG Integration is the inclusion of ESG factors into the financial analysis and investment process of money managers. This may entail the inclusion of potential ESG risks and opportunities and their possible effect on estimated future cash flows or balance sheet assets and liabilities. According to the US SIF Trends Report 2020, the most commonly applied approach to ESG investing is now ESG Integration. Of the money managers responding to the US SIF Trends survey, 74 percent reported applying ESG Integration into their investment process, affecting just shy of $3.5 trillion of assets under management. Similarly, of the institutional investors responding, 68 percent reported incorporating ESG Integration into their organization’s portfolios, representing $495 billion of assets.

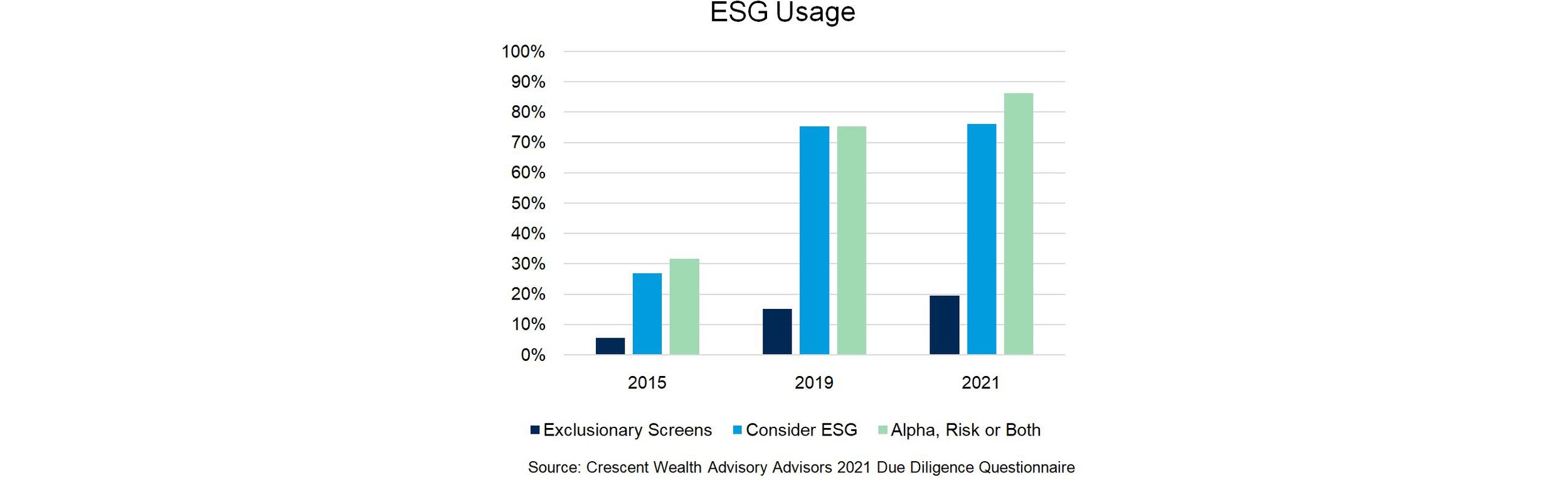

Our findings show a similar trend. According to our 2021 proprietary survey sent to Crescent Wealth Advisorys' recommended public markets strategies, 86 percent of respondents as of December 6, 2021 use ESG as a component of an investment’s alpha or risk assessment. Our findings also show an increasing trend in ESG Integration, as shown below:

This is good news for investors who wish to incorporate ESG into their portfolio. Historically, investors may have needed to make significant changes to their holdings, vehicle types and/or asset allocation to align their portfolio with ESG principles. With ESG integration being more common that may no longer be necessary. Investors with ESG interests may be pleasantly surprised to find “non-ESG” strategies have already incorporated some of these factors in their portfolios.

However, we would temper the idea that ESG integration is now pervasive and common place. It is important to note that these trends are self-reported. It likely comes with little surprise that as interest grows for ESG investing and more capital moves in that direction that the asset management community would respond favorably. This begs the question, with so many managers self-reporting ESG Integration how many are doing so in a meaningful way?

In assessing ESG Integration practices, we generally ask ourselves three primary questions:

• Is it observable in the investment process?

• Is it material to the investment process?

• Is it additive to the investment process?

In other words, through due diligence, can you distinctly observe the incorporation of additive ESG factors within a money manager’s investment process? Applying this framework, we believe 35 percent of our recommended public markets strategies meaningfully integrate ESG analysis into the investment process. That differs from the 86 percent of respondents self-reporting Integration. There are a couple of notable takeaways from this observation.

1. Such a gap is not surprising to us. ESG in general, and ESG Integration in particular, can be difficult to define and assess. Therefore, it is easy to claim without needing material changes to the investment process to back it up. Additionally, with interest growing from investors, asset managers have an economic incentive to move toward ESG in hopes of attracting new capital.

2. This further highlights the benefits of conducting deeper research on a strategy rather than simply relying on information provided. We believe greenwashing effect is likely to persist for some time as the industry comes to terms with common definitions and better sources of data.

3. 36 percent is still a very meaningful percentage of our recommended investment strategies that we believe are truly considering ESG factors as part of their investment process. While well shy of the survey respondents rate of 86 percent, we believe most would be surprised that on average over a third of their portfolio, which does not have ESG titled investments, may use ESG information as part of the investment process.

One of the more powerful outcomes from this deeper level of analysis is how we help our clients interested in ESG investing. If our assessment is correct and less than half of self-proclaimed ESG Integrators incorporate ESG in a meaningful way many investors may be stuck in platitude purgatory. In other words, investors often with good intention believe they are taking actions to help further their mission, but in reality, are having a limited impact. We believe by digging through greenwashing, by exploring additional ways beyond just Integration to further your mission and by being pragmatic we help our clients avoid this common pitfall.

If you would like to learn how Crescent Wealth Advisory helps our clients avoid platitude purgatory and pragmatically integrate ESG into their portfolios, please reach out to any of the professionals at Crescent Wealth Advisory.

For more information, please contact the professionals at Crescent Wealth Advisory.

Download a PDF of this blog.

Note: This report is intended for the exclusive use of clients or prospective clients of Crescent Wealth Advisory. Content is privileged and confidential. Any dissemination or distribution is strictly prohibited. Information has been obtained from a variety of sources believed to be reliable though not independently verified. Any forecast represents future expectations and actual returns, volatilities and correlations will differ from forecasts. Past performance does not indicate future performance. The information presented does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice.