In Focus – Russian Invasion of Ukraine

Current Update, Implications & Outlook

By Crescent Team

WHY IS RUSSIA INVADING UKRAINE?

Officially, Russia claims to be taking action to protect Russian citizens, especially those in the self-proclaimed Russian republics of Donetsk and Luhansk who declared independence in 2014 (when Russia last invaded Ukraine). However, Russian interests go much deeper. The collapse of the Soviet Union in 1991 left Russia vastly depleted from its former days of empire building. Security analysts believe this “one people, single whole” mentality is the true root of the invasion.

WHAT IS HAPPENING IN UKRAINE?

On February 23, 2022, Russia launched a series of coordinated attacks on key military targets across Ukraine including air, ground and amphibious assaults. The situation remains fluid.

HOW HAVE MARKETS REACTED?

Risk assets retreated given this unfortunate news. Equities, even those with little connection to any activities in the region, broadly sold off in sympathy. Gold, treasuries and other risk-off havens gained in value. Commodity markets also reacted, with oil prices jumping to over $100 a barrel. European natural gas contracts increased as much as 50 percent based on the news, particularly because Russia is a major supplier to Europe. This type of reaction in energy markets is common with an increase in geopolitical risk, but the timing also comes on the heels of limited global energy supplies, recent underinvestment in production and continued supply chain disruptions. Even before recent actions, Russian equity markets have seen significant downward pressure. As of February 22, 2022, the Russian equity market was down over 22 percent year to date. Globally, currency markets are reacting as well. The Russian Ruble fell materially relative to the U.S. dollar and Ukraine suspended its currency operations under martial law.

HOW DOES THIS IMPACT PORTFOLIOS?

Most acutely, Russia is 3.29 percent(1) of the MSCI Emerging Markets Index. While it is an important geopolitical player in Europe and on the global stage, it is less impactful in global markets. Additionally, it is important to remember the Emerging Markets are a collection of countries with different economic and geographical realities. While the Russian invasion is most likely to hurt the country itself and its immediate neighbors, other countries may benefit. For example, Brazil benefited from higher oil prices globally and if tensions keep prices up, it may continue to do so in the future. Brazil is 4.32 percent(1) of the index today and increased materially in 2022. Additionally, companies outside of Russia may experience more nuanced impacts. For example, French car manufacturer Renault has a subsidiary in Russia and its stock traded off materially based on the news.(1) Within global fixed income markets, Russia accounts for 0.25 percent(3) of the Bloomberg Global Aggregate Index and therefore is a modest contributor to overall risk of the index.

DOES THIS IMPACT THE FED’S DECISION ON INTEREST RATES?

Central banks globally, including the Fed, are in a difficult position. With an interest to keep prices under control while not smothering economic growth, they are walking a fine line. Markets largely expect a 0.25 percent increase from the Fed after its mid-March meeting. However, conversation has drifted to a 0.50 percent increase given recent headline inflation numbers. The invasion adds fuel to the inflation fire with higher energy prices, but it may provide the Fed cover to raise rates at a more modest 0.25 percent level based on greater uncertainty. Futures markets imply that a 0.50 percent rate hike is less likely post-invasion than it was the day before, reflecting this change in sentiment as shown below.

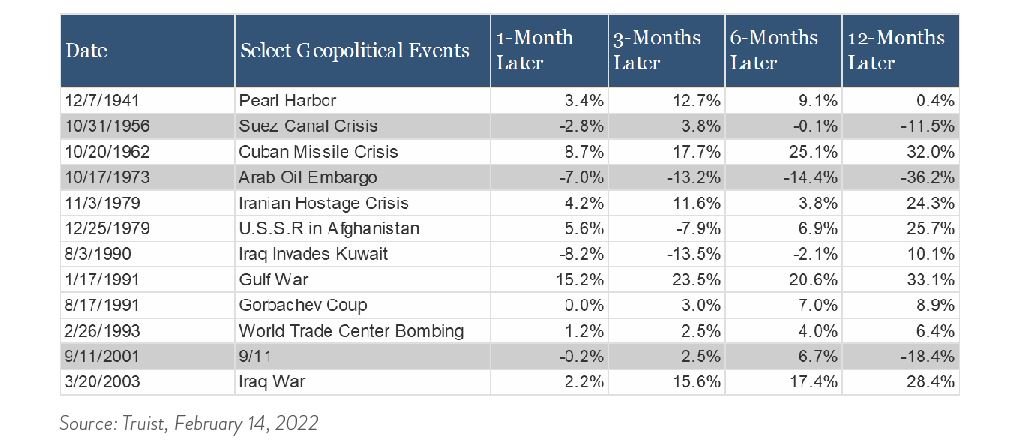

WHAT CAN HISTORY TELL US ABOUT SUCH EVENTS?

Sadly, such tragic humanitarian events are not unprecedented. While the social impact cannot be understated, the impact on economies and markets have historically been modest following other similar actions.

Below is a selection of several geopolitical events and market returns following such events. Those highlighted in light green overlap with a recession. Barring a major escalation to conflict, we do not believe Russia’s actions will materially change the likelihood of recession.

WHAT IS THE RESPONSE FROM THE U.S. AND OTHER ALLIES?

The situation remains fluid. On February 22, 2022, President Biden (as well as the EU, UK, Australia and Japan) signed an executive order that bars Americans from investing in, trading with or lending to these regions. This order prohibits 1) new investments in these regions by a U.S. person 2) import of any goods, services, or technologies 3) export of any goods, services, or technologies from the U.S. to these regions.⁴ It is worth noting, this does not prohibit the purchase and sale of public market securities in the regions. As a result of more aggressive actions, the U.S. Senate and other allies are proposing additional sanctions that are likely to target Russian banking institutions and the distribution of natural gas to the European region. Strategic action from the United Nations (UN) and North Atlantic Treaty Organization (NATO) may be hampered given Russia’s involvement with both organizations and the fact that Russia is the current President of the UN Security Council.

HOW DOES THIS IMPACT OUR OUTLOOK?

While this is a very unfortunate humanitarian event, we believe this war has limited global significance to broader themes built into our portfolios and our forward-looking capital market assumptions. As a reminder, we entered the year believing market volatility would be elevated. Additionally, our outlook looks beyond the immediate future and seeks to allocate based on expectations over the next 10 years. While this invasion is a material headline event today, we believe the impact over the next 10 years is likely to be limited. Should the facts change in coming days and weeks, so will our opinion. We will continue to monitor the situation closely for both growing risks and opportunities.

If you would like to learn how Crescent Wealth Advisory helps our clients avoid platitude purgatory and pragmatically integrate ESG into their portfolios, please reach out to any of the professionals at Crescent Wealth Advisory.

1) MSCI EM NR USD February 23, 2022

2) WSJ: Russian Attacks on Ukraine Roils Markets

3) PGIM January 31, 2022

4) The White House, February 22, 2022

For more information, please contact the professionals at Crescent Wealth Advisory.

Download a PDF of this blog.

Note: This report is intended for the exclusive use of clients or prospective clients of Crescent Wealth Advisory. Content is privileged and confidential. Any dissemination or distribution is strictly prohibited. Information has been obtained from a variety of sources believed to be reliable though not independently verified. Any forecast represents future expectations and actual returns, volatilities and correlations will differ from forecasts. Past performance does not indicate future performance. The information presented does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice.