Quarterly Considerations - Fourth Quarter 2022

By Crescent Team

MARKET THEMES

ECONOMIC REVIEW

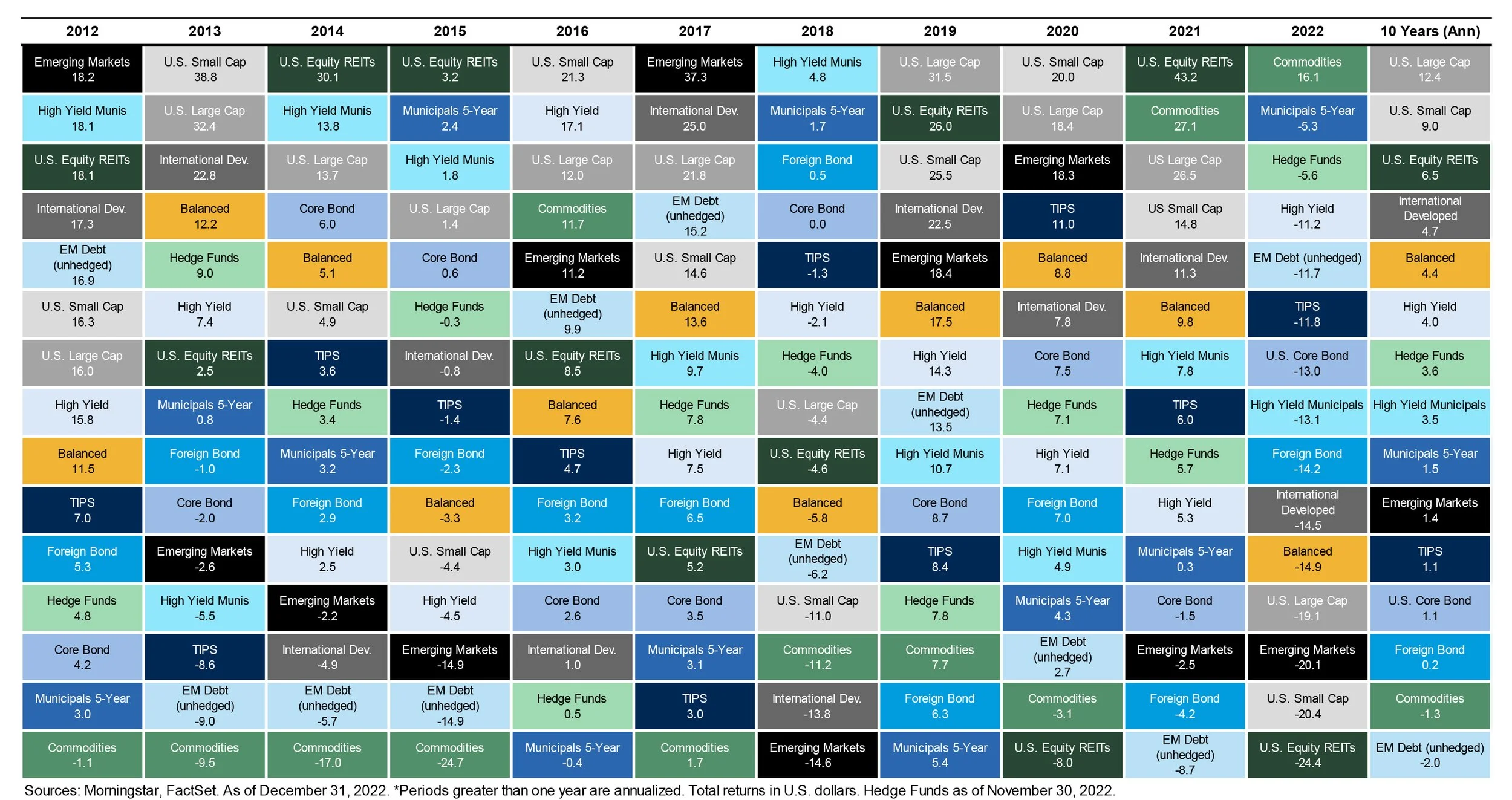

ASSET CLASS RETURNS

FIXED INCOME MARKET UPDATE

EQUITY MARKET UPDATE

REAL ASSET MARKET UPDATE

THE CASE FOR DIVERSIFICATION

FINANCIALS MARKETS PERFORMANCE

Download a PDF of this blog.

DISCLOSURES AND DEFINITIONS

All material and information is intended for Crescent Wealth Advisory business only. Any use or public dissemination outside firm business is prohibited. Information is obtained from a variety of sources which are believed though not guaranteed to be accurate. Any forecast represents future expectations and actual returns, volatilities and correlations will differ from forecasts. Past performance does not indicate future performance. This presentation does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice.

When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise notes. Each index is unmanaged, and investors can not actually invest directly into an index:

TIPS: Bloomberg US Treasury US TIPS TR USD

Municipals 5-Year: Bloomberg Municipal Bond 5 Year (4-6) TR USD

U.S. Core Bond: Bloomberg US Aggregate Bond TR USD

High Yield Municipals: Bloomberg HY Muni TR USD

High Yield: Bloomberg US Corporate High Yield TR USD

U.S. Long Duration: Bloomberg U.S. Long Government/Credit TR USD

Foreign Bond: Bloomberg Global Aggregate ex-USD TR USD (50/50 blend of hedged and unhedged)

EM Debt (unhedged): J.P. Morgan GBI-EM Global Diversified Composite Unhedged TR USD

U.S. Large Cap: Russell 1000 TR USD

U.S. Small Cap : Russell 2000 TR USD

International Developed: MSCI EAFE NR USD

Emerging Markets: MSCI Emerging Markets NR USD

U.S. Equity REITs: FTSE Nareit Equity REITs TR USD

Real Assets: S&P Real Assets TR USD

Commodities: Bloomberg Commodity TR USD

Hedge Funds: Hedge Fund Research HFRI Fund of Funds Composite USD

Foreign Bond Unhedged: Bloomberg Global Aggregate ex USD TR USD unhedged

U.S. MBS: Bloomberg US MBS (30Y) TR USD

Balanced: 18% U.S. Large Cap, 6% U.S. Small Cap, 5% U.S. Equity REITs, 16% International Developed, 4% High Yield, 8% Emerging Markets, 3% TIPS, 33% U.S. Core Bond, 2% Foreign Bond, 3% Commodities, 2% EM Debt (unhedged).

Equity valuations are based on trailing 12-month P/E ratios for S&P 500 Index (U.S.), MSCI EAFE Index (Int’l Developed), and MSCI EM Index (Emerging Markets)

S&P 500 sector performance based on the following indices: S&P 500 Sec/Commun Services TR USD, S&P 500 Sec/Financials TR USD, S&P 500 Sec/Energy TR USD, S&P 500 Sec/Industrials TR USD, S&P 500 TR USD, S&P 500 Sec/Health Care TR USD, S&P 500 Sec/Cons Disc TR USD, S&P 500 Sec/Utilities TR USD, S&P 500 Sec/Cons Staples TR USD, S&P 500 Sec/Materials TR USD, S&P 500 Sec/Information Technology TRUSD, S&P 500 Sec/Real Estate TR USD

Equity country returns based on the following indices: U.S.: MSCI USA NR USD, China: MSCI CHINA NR USD, Japan: MSCI Japan NR USD, Germany: MSCI Germany NR USD, United Kingdom: MSCI NR USD, India: MSCI India NR USD, France: MSCI France NR USD, Italy: MSCI Italy NR USD, Canada: MSCI Canada NR USD, Korea: MSCI Korea NR USD, Energy:

Commodity Performance based on the following indices: Energy: Bloomberg Sub Energy TR USD, Industrial Metals: Bloomberg Sub Industrial Metals TR USD, Precious Metals: Bloomberg Sub Precious Metals TR USD, Agriculture: Bloomberg Sub Agriculture TR USD

REIT sector performance is based on the following indices: FTSE Nareit Equity Health Care TR,FTSE Nareit Equity Lodging/Resorts TR, FTSE Nareit Equity Office TR, FTSE Nareit Equity Data Centers TR, FTSE Nareit Equity Diversified TR, FTSE Nareit Equity Specialty TR, FTSE Nareit Equity Retail TR, FTSE Nareit Equity Residential TR, FTSE Nareit Equity Industrial TR, FTSE Nareit Equity Self Storage TR

Formal HFRI Benchmark Names: HFRI Fund of Funds Composite Index, HFRI Asset Weighted Composite Index, HFRI Equity Hedge (Total) Index - Asset Weighted, HFRI Event Driven (Total) Index - Asset Weighted, HFRI Macro (Total) Index - Asset Weighted, HFRI Relative Value (Total) Index - Asset Weighted, Fund of Funds Composite is not asset weighted.